Hedging Foreign Exchange Exposure With Structured Products

Suppose an exporter company makes regular exports 1,000,000 USD per month and wants to hedge its foreign exchange exposure. In this example the comapany is supposed to be a Turkish Company whose domestic currency is Turkish Lira (TRY) and the foreign exchange exposure that the company is faced with is USD/TRY exposure. The exporter company will be long at USD/TRY parity by its exporting activities and should sell USD/TRY in order to hedge its exposure. The spot USD/TRY parity in our example is 1.7885.

If this company wants to hedge its annual FX exposure there are possible alternatives;

Forward Contracts: The company can sell USD/TRY on a series of forward contracts. There will be 12 forward contracts on different expiry dates.

| Time to expiry | Forward Rates |

| 1 month | 1.8009 |

| 2 month | 1.8130 |

| 3 month | 1.8243 |

| 4 month | 1.8372 |

| 5 month | 1.8475 |

| 6 month | 1.8613 |

| 7 month | 1.8727 |

| 8 month | 1.8841 |

| 9 month | 1.8954 |

| 10 month | 1.9054 |

| 11 month | 1.9158 |

| 12 month | 1.9273 |

Average forward rate is 1.8737.

This company can choose a structured product composed of some FX options. Here we will cover some of the structured product alternatives that a company can use to hedge its FX exposure.

These products are

Asymetric Forward,

Zero Cost Collar and

Seagull which are all composed of european vanilla options. (Please click on the links in order to have more idea about the products) These products can be priced with derivativeengines real time stuctured product enginees. The exporter can also use the products like

Asymetric Forward KO,

Zero Cost Collar KO,

Forward KO,

Forward KI,

Forward Extra etc, which are also priced in derivativeengines. These products are composed of american barrier options and in this article we will cover only the vanilla product alternatives. The pricing alternatives for the strip of Asymetric Forward, Zero Cost Collar and Seagull products are below. You can price these products by clicking on the below links

Asymetric Forward Pricing with accumulating expiry (Strip of asymetric forwards) - Need login for accumulating (strip)pricing

Asymetric Forward Level: 1.9025

Leverage: 2

Minimum Notional: 500,000 USD

Meaning that the exporter company will sell 500,000 USD if spot rate at the specific expiry date is below 1.9050 and will sell 1,000,000 USD if spot rate at the specific expiry date is above 1.9050. If spot is below 1.9050 then half of the exposure is hedged from the spot level and half of the exposure is hedged from 1.9050 level which is 323 bps above the forward level.

Zero Cost Collar Pricing with accumulating expiry (Strip of zero cost collars) - Need login for accumulating (strip)pricing

Lower Band Level: 1.7885

Higher Band Level: 2.010

If the exporter has a view that the spot rate will increase he can speculate the exposure according to this view while having a protection by using zero cost collar product. If the market moves higher according to the view of the exporter he can get the advantage of the price move upto 2.010 level for USD/TRY. On the other hand if the market moves against his view the exporter has a protection at spot level 1.7885.

Seagull Pricing with accumulating expiry (Strip of seagulls) - Need login for accumulating (strip)pricing

Lower Band: 1.7885

Profit Cap: 1.7300

Upper Band: 2.1000

Exporter puts a cap to its protection and increases its advantage when the spot moves higher.

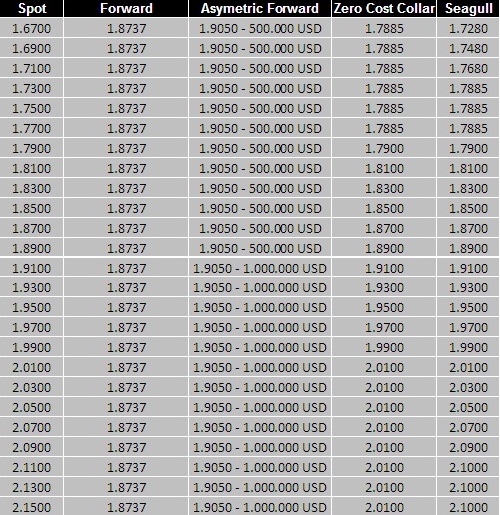

You can see the change of the average hedging cost of the exporter in the below table.

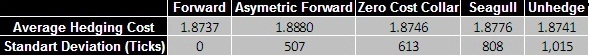

If the exporter applies both of the products many times there should be no difference on the average payoffs from the risk neutral pricing point of view. In order to analyze the payoffs of the products we modeled the spot rate at the 12 expiry dates by Monte Carlo Simulation. We runned 10,000 scenarios and calculated the average hedging cost for each products. The volatility rate for 1 month is accepted as % 8.75 and the forward curve is accepted to be flat. The average cost of the products in 10,000 scenario and their standart deviation is below;

As you can see the average costs of the products are identical in the long run. If the exporter does not hedge its exposure he will face with a 1015 ticks standart deviation for average cost of his exposure. If the exporter does not want to face with volatility for the cost of his exposure he should hedge all the exposure with forwards. On the other hand the exporter may wish to decrease the volatility of his average cost but do not want to make it zero. In this case structured products allow the hedger to apply his market view by decreasing the volatility of the outcomes according to unhedged scenario.

The use of stripped or accumulating products become useful when the hedger needs to short the currency whose domesitc interest rate is greater than the foreign interest rate. The hedger gets the advantage of the higher long term forward levels. Since the transaction is realized from an average rate the initial transaction of the product will be probably at a very advantageous level according to spot rate. For example in the accumulating asymetric forward case hedger begins to sell the USD/TRY parity from 1.9050 level 1 month later the transaction date.

Derivative Engines Real Time Option Pricing Engines are free for a limited time.

Sign Up free...

Sign in

Sign Up

- What can you do with Derivative Engines ?

Option Pricing

- Single Vanilla Option

- A Portfolio of Vanilla Options

- Single Barrier Options

- Binary Options

More in research...

Structured Products Pricing

- Investment Products

- Hedging Products

- Trading Products

More in research...

Trading Strategy Auto Suggestor

On research...